NFTs (Non-Fungible Tokens) have evolved from a speculative frenzy to a diverse asset class with real-world applications. As we step into 2025, the NFTs are expected to mature significantly, driven by technological advancements, regulatory clarity, and shifting investor sentiment. Let’s explore the key predictions shaping the future of NFT investments.

But first things first, what are NFTs?

What is an NFT?

An NFT is a unique digital asset that represents ownership or proof of authenticity of a specific item, such as artwork, music, videos, virtual real estate, or even in-game assets. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible (interchangeable), NFTs are non-fungible. Meaning, each one is distinct and cannot be exchanged on a one-to-one basis. They are stored on blockchains, ensuring transparency, security, and verifiable ownership.

Think of an NFT like a rare, autographed trading card. While anyone can print a picture of that card, only one person owns the original, signed version, making it unique and valuable. Similarly, an NFT proves the ownership and authenticity of a digital asset, even if copies exist online.

When Did NFTs Peak?

NFTs reached their peak in late 2021 and early 2022, fueled by a mix of speculative hype, celebrity endorsements, and a booming crypto market. Several key moments defined this era:

- Record-Breaking Sales: In March 2021, Beeple’s digital artwork Everydays: The First 5000 Days sold for $69 million at Christie’s, marking a turning point for NFTs as high-value digital assets.

- Bored Ape & PFP Mania: Collections like Bored Ape Yacht Club (BAYC) and CryptoPunks dominated headlines, with NFTs becoming digital status symbols for celebrities and influencers.

- Metaverse & Play-to-Earn Hype: Virtual land sales in platforms like Decentraland and The Sandbox soared, while games like Axie Infinity promised sustainable play-to-earn models (which later collapsed).

- Mainstream Adoption: Major brands like Nike, Adidas, and Coca-Cola jumped in, launching NFT drops and collaborations to engage Web3-savvy audiences.

- Market Crash & Decline: By mid-2022, the NFT market started cooling as crypto prices fell, liquidity dried up, and many speculative projects collapsed.

NFT market predictions for 2025

According to Statista, revenue in the NFT market is projected to reach $608.6 million in 2025, with an estimated 11.64 million users globally. The average revenue per user (ARPU) is expected to be $52.3, and the United States is set to lead the market, generating approximately $115.2 million in revenue.

These figures indicate a more stabilized but smaller market compared to the peak years, reflecting a shift toward utility-driven NFTs rather than speculative trading.

Let’s explore some promising trends we can expect to shape the NFT market in 2025.

1. Hybrid NFTs

Hybrid NFTs combine the best of both worlds—linking a digital NFT to a real-world asset, experience, or privilege. Unlike traditional NFTs, which exist solely in digital form, hybrid NFTs offer tangible value by tying blockchain-based ownership to physical goods or exclusive services.

Hybrid NFTs matter because they bridge the gap between Web3 and the real world, making blockchain technology more accessible and practical. By linking digital ownership to physical assets or experiences, they enhance security and authenticity. This reduces counterfeits in industries like luxury goods and art. Additionally, hybrid NFTs add real-world utility, ensuring that their value extends beyond speculation. This can drive broader adoption and long-term sustainability

How Hybrid NFTs Work

A hybrid NFT typically consists of:

- A Digital NFT – A blockchain-based token that verifies authenticity, ownership, and provenance.

- A Physical or Real-World Component – This could be a luxury product, artwork, event access, merchandise, or even real estate.

Examples:

- Nike’s Cryptokicks: A digital NFT representing ownership of a physical sneaker.

- Luxury Watches & Art: Brands like Jacob & Co. have launched NFTs linked to high-end timepieces, proving authenticity and ownership.

- Event & Membership NFTs: Some NFTs grant VIP access to concerts, clubs, or networking events, making them more than just collectibles.

2. Utility-based NFTs

While NFTs initially gained popularity through digital art and collectibles, their potential now extends far beyond that, with real-world utility in decentralized finance (DeFi), gaming, identity management, and even real estate. This shift is making NFTs more than just speculative assets—they are becoming functional tools that drive value across various industries.

In DeFi, NFTs can be used as collateral for loans, allowing users to leverage their digital assets without selling them. Platforms are also exploring NFT-based yield-generating instruments, where holders can stake their NFTs to earn rewards. These innovations bring liquidity and financial utility to NFTs, making them an integral part of the DeFi ecosystem.

In gaming, NFTs represent unique characters, weapons, or virtual assets that offer players exclusive benefits, such as early access, special abilities, or cross-platform compatibility. Unlike traditional in-game purchases, NFT-based assets provide true ownership, enabling players to trade or sell them freely across different platforms. This fosters a player-driven economy where in-game achievements hold real-world value.

Beyond finance and gaming, utility-driven NFTs are emerging in identity verification, memberships, ticketing, and real estate. NFT-based digital identities can help users maintain control over their personal data, while NFT ticketing can reduce fraud in concerts and events by verifying authenticity on the blockchain. In real estate, NFTs are being explored for property ownership and fractionalized investment, allowing multiple investors to hold shares in high-value assets.

3. Bitcoin NFTs

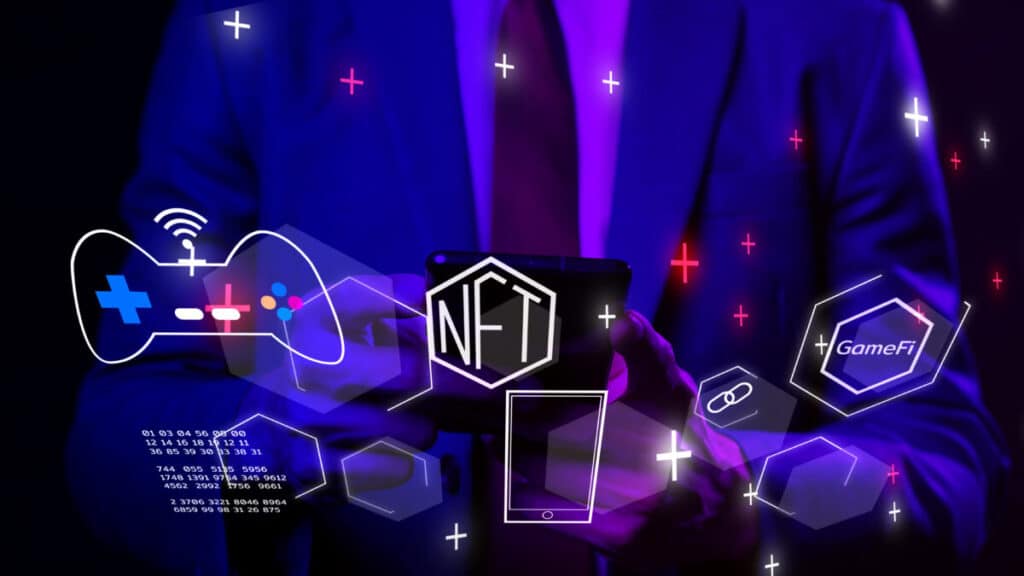

While Ethereum and other smart contract platforms initially dominated the NFT space, Bitcoin NFTs have gained significant traction thanks to the development of Ordinals and the recent introduction of Runes. These innovations allow NFTs to exist natively on the Bitcoin blockchain, bringing digital collectibles, inscriptions, and tokenized assets to the most secure and decentralized network in crypto.

Ordinals: The First Wave of Bitcoin NFTs

Ordinals, introduced in early 2023, allow individual satoshis (the smallest unit of Bitcoin) to be inscribed with unique data, such as images, text, or even videos. Unlike Ethereum-based NFTs, which rely on smart contracts, Ordinals are fully on-chain, making them more permanent and censorship-resistant. This innovation spurred a wave of Bitcoin-native digital art, collectibles, and experimental NFT projects, attracting both artists and investors.

Why Ordinals Matter:

- True on-chain storage: Unlike many Ethereum NFTs, which store metadata off-chain, Ordinals exist entirely on the Bitcoin network.

- Scarcity & provenance: Since Bitcoin is finite, inscribing data onto satoshis creates a new form of digital scarcity.

- Security & decentralization: Being part of the Bitcoin blockchain makes these NFTs more immutable than those on other chains.

However, the rise of Ordinals also led to increased network congestion and higher transaction fees on Bitcoin, raising concerns among some BTC purists.

Runes: The Next Evolution of Bitcoin NFTs & Tokens

Following the success of Ordinals, the Runes protocol was introduced to improve Bitcoin’s ability to handle fungible tokens (akin to ERC-20 tokens on Ethereum) while maintaining efficiency. Runes are designed to be lighter, more scalable, and more structured than Ordinals, enabling Bitcoin to support tokenized assets and NFT-like functionalities without excessive blockchain bloat.

Why Runes Are Game-Changing:

- Optimized for Bitcoin’s UTXO model, making them more efficient than older tokenization methods like BRC-20s.

- Enable a new wave of Bitcoin-native assets, including gaming NFTs, digital collectibles, and tokenized financial instruments.

- Potential DeFi applications, such as tokenized BTC staking, lending, and trading, bringing more utility to the network.

The Future of Bitcoin NFTs

With both Ordinals and Runes expanding Bitcoin’s utility beyond a store of value, we are seeing the emergence of a new Bitcoin-based NFT economy. Major marketplaces and wallets are adapting to support Bitcoin NFTs, and brands are experimenting with inscriptions as a form of verifiable digital ownership.

4. Real World Assets (RWAs) tokenization

Real-World Asset (RWA) tokenization isn’t a new concept, but it’s set to be one of the biggest NFT trends in 2025. The idea of representing physical assets—such as real estate, commodities, fine art, and even financial instruments—on the blockchain has been around for years. However, challenges like regulatory uncertainty, liquidity concerns, and infrastructure limitations slowed its mainstream adoption. With the maturation of blockchain technology, improved legal frameworks, and growing institutional interest, 2025 could be the year RWA tokenization fully takes off—with NFTs playing a key role in bridging traditional finance and Web3.

NFTs provide a transparent, immutable way to verify ownership and trade fractional shares of RWAs, unlocking liquidity in historically illiquid markets. Instead of dealing with complex legal paperwork and intermediaries, assets like real estate deeds, luxury collectibles, and even carbon credits can be tokenized and traded seamlessly. Major financial players are already exploring tokenized securities, and as traditional markets integrate blockchain-based infrastructure, NFTs could evolve beyond digital art into standardized, regulated instruments for asset ownership.

5. NFTs in Music and Sports industry

NFTs are creating new ways for fans to interact with their favorite teams, athletes, and artists. Unlike traditional digital merchandise or concert tickets, NFTs provide verifiable ownership, exclusivity, and real-world utility, making them much more than just collectibles.

NFTs in Sports

Sports teams, leagues, and athletes have embraced NFTs to offer exclusive digital collectibles, game highlights, and even tokenized ownership stakes in teams or events. Some key applications include:

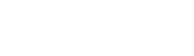

- Digital Trading Cards & Moments: Platforms like NBA Top Shot allow fans to own officially licensed highlights as NFTs, turning iconic plays into digital collectibles.

- Tokenized Tickets & VIP Access: NFT-based ticketing prevents fraud and offers added perks, such as access to exclusive meet-and-greets or behind-the-scenes content.

- Fan Tokens & Engagement: Clubs like FC Barcelona and Paris Saint-Germain issue fan tokens that allow supporters to vote on club decisions, access rewards, and engage with players in unique ways.

NFTs in Music

In the music industry, NFTs are reshaping how artists distribute music, connect with fans, and earn revenue without relying solely on streaming platforms or record labels. Some key innovations include:

- Exclusive Music Releases: Artists like Kings of Leon and Snoop Dogg have launched albums as NFTs, giving fans limited-edition access to special tracks, album artwork, and concert perks.

- Concert & Event NFTs: NFT-based ticketing ensures authenticity, prevents scalping, and can even include lifetime backstage access for superfans.

- Royalty-Sharing & Decentralized Music Ownership: Platforms like Royal and Audius enable fans to own fractional shares of songs, meaning they earn royalties whenever the track is streamed or sold.

Conclusion

As we enter 2025, NFTs are set to become more practical and valuable, moving beyond hype into real-world use. They’re being integrated into finance, gaming, music, and sports, offering utility beyond just digital collectibles. Hybrid NFTs, Bitcoin NFTs, and real-world asset tokenization are making them more relevant than ever. With better regulations and blockchain advancements, NFTs will continue to grow, proving they’re not just a trend but a lasting shift in digital ownership and commerce.