Investing in NFTs comes with a high level of risk due to the market’s extreme volatility and unpredictability. Prices can rise or crash in a matter of days—or even hours. While some investors see massive returns and “go to the moon,” others break even, and many are left holding NFTs that eventually lose their value entirely.

That’s why it’s critical to DYOR—do your own research—before putting money into any NFT project. Don’t rely on hype alone. Instead, look for collections with:

- Real utility (use cases beyond just buying and selling)

- Strong community backing

- Transparent, experienced teams

- A roadmap built for long-term value

- Resilience in both bull and bear markets

NFTs can offer exciting opportunities, but smart investing starts with informed decision-making.

Are NFTs Still Worth Anything? Analyze the NFT Market First

Yes, NFTs are still valuable and remain an active part of the digital asset space despite their sky-high peaks and devastating crashes over time. In 2021, the global net sales volume from NFTs was around $25 billion and about 28.6 million wallets traded Non Fungible Tokens. It is expected to reach $211.7 billion by 2030, driven by increased mainstream adoption, new use cases, and trends.

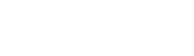

According to a report by Statista, the number of new NFT users is anticipated to reach 11.64 million in 2025, with a user penetration rate increasing to 0.15%.

Despite market fluctuations, some NFT collections like Crypto Punks, Azuki, Bored Ape Yacht Club, Guild of Guardians, Chromie Squiggle, and Pudgy Penguins continue to maintain steady sales volume.

So if you’re planning to invest in NFTs, invest in good projects like these. Because an NFT project with a clear roadmap and long-term vision can weather even the toughest bearish markets, and you’ll have a better chance of holding onto value.

How to Spot A Good NFT Project?

Not all NFT projects are created with a long-term vision and goal. Some are just hype trains waiting to derail. With numerous projects flooding the market, how do you know if an NFT project is good or just a future flop? Here are 11 things to consider when you research NFT projects.

1. Know The Team Behind the Project

When you invest in an NFT project, you’re not just investing in the art, you’re investing in the team behind it. So, it’s a wise move to research the creators of the project. A strong team with previous experience in the Web3 space is a key indicator of credibility and significantly increases the chances of the project’s success.

Get to know the founders, artists, technologists, and everyone involved. How long have they been in the industry, and what roles have they played in the past? If they faced setbacks, how did they handle them? Are they in the Web3 market for a quick flip, or are they in it for the long haul?

You can learn about the team through Twitter and Instagram accounts, or by engaging in Discord Servers, Reddit, or Alpha groups.

2. Read the White Paper

A white paper is a detailed document that maps out the goals and strategies for marketing and future developments. It gives you more insights into the project’s roadmap, future updates, and expansions. Many legitimate NFT projects have white papers with clear plans on how they are planning to make a stable income from the funds raised from the Mint. For instance, if they do things out of the ordinary like sharing a percentage with charity, it’s a good sign.

If a project’s earnings are solely based on Art/Community and rely on Royalties as their sole income source, that is also an acceptable model. In fact, projects with revenue models like staking rewards and marketplace fees tend to survive longer.

When you evaluate an NFT project, keep one thing in mind that the project’s plan must be realistic and optimistic; not a copy-cat business idea from Web2. If you like the uniqueness in the roadmap and are confident that the team will be able to pull it off, then invest in the project.

However, if you think their idea doesn’t make sense, then follow your gut.

3. Look at the NFT Launchpad

NFT launchpads are blockchain platforms where NFT projects are launched such as Ethereum blockchain or Solana. The choice of chain really matters in the success of any NFT project. The blockchain on which the project is minted can significantly impact its adoption, reach, scalability, and overall value. Ethereum and Solana are currently among the most popular and high-performance blockchain platforms due to their larger user bases.

However, most investors prefer to invest in ERC20 tokens because they have high liquidity. Buyers can easily buy them with ETH and trade them on various platforms with minimal friction.

But it doesn’t necessarily mean that Ethereum is good for every collection. Sometimes, less saturated blockchains like Ripple, Tezos, Polygon and new entrants like Avalanche and Flow can also turn out to be a blue ocean for NFT projects. Because of their lower gas fees and a different target audience.

To evaluate if the NFT project is launched on the right blockchain, see if the target audience of the blockchain aligns with the project’s narrative and goals.

4. Understanding Tokenomics

Tokenomics (token+economics) is the financial model of an NFT project that defines how native tokens are created, the total supply of tokens (is it fixed or inflationary), how they are distributed, used, and maintained within a blockchain ecosystem. How those tokens will gain value over time and what incentives are there for holders.

Understanding tokenomics will help you understand the growth potential, risks, and sustainability of a project. A poor token economy can lead to price volatility and eventual collapse.

5. The Rarity of NFTs

The NFT community has a deep appreciation for rare NFTs—how scarce or unique a collection is. Scarcity increases desirability and can drive up value. See if the art style is appealing or unique? Does the collection have a clear narrative? Does each NFT have unique traits or qualities? How many variations of each token exist within the collection?

To evaluate a good NFT project, pay attention to the narrative of the NFT set and how it connects with the community. For example, look at collections like Bored Ape Yacht Club, Azuki Beans, CryptoKitties, and Everydays: The First 5000 Days by Beeple.Every NFT in these collections is one-of-a-kind and contributes to the overall narrative or theme of the project.

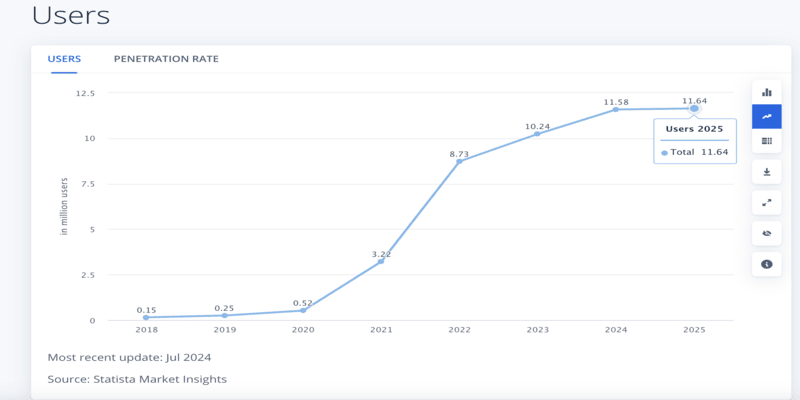

If you want to check the rarity of the art, use tools like Rarity.tools, Rarible, HowRare.is, and Traitsniper. To use these tools, search for a specific NFT collection, such as Bored Ape Yacht Club, and filter the results from rarity high to low. You will see the NFTs with more rare attributes.

This result is shown based on the rarest trait of each NFT.

The rarity score of the NFTs is calculated based on factors such as the number of tokens in circulation and how long they have been available for sale.

A rarity score between 1-5% is good and the NFT is considered rare.

6. Utility

Utility refers to the applicability of NFTs in the real and the digital world. The more applicable an NFT is in these domains, the more valuable it becomes. During the process of NFT valuation, see if it provides any real-world utility beyond just collectability.

Can the holder use the NFT within a metaverse or gaming ecosystem?

NFTs with high utility value have use cases such as gaming assets, metaverse properties, membership perks, event tickets, governance voting, or decision making in the project’s ecosystem.

Another way to increase the utility of the NFT is by offering free minting opportunities or whitelist rights to holders for future releases of NFT sets.

7. Good Wallet Decentralization

This means how many unique holders are there for a specific NFT rather than being concentrated in a few wallets. This is a sign of a more engaged community and reduces the risk of market manipulation by a small group of investors (whales).

To check if an NFT project has a good wallet decentralization, look at the number of wallet ownership of a specific collection in any NFT marketplace. Ideally, the ideal average number of NFTs per wallet should be 4 or less, as this indicates a strong distribution.

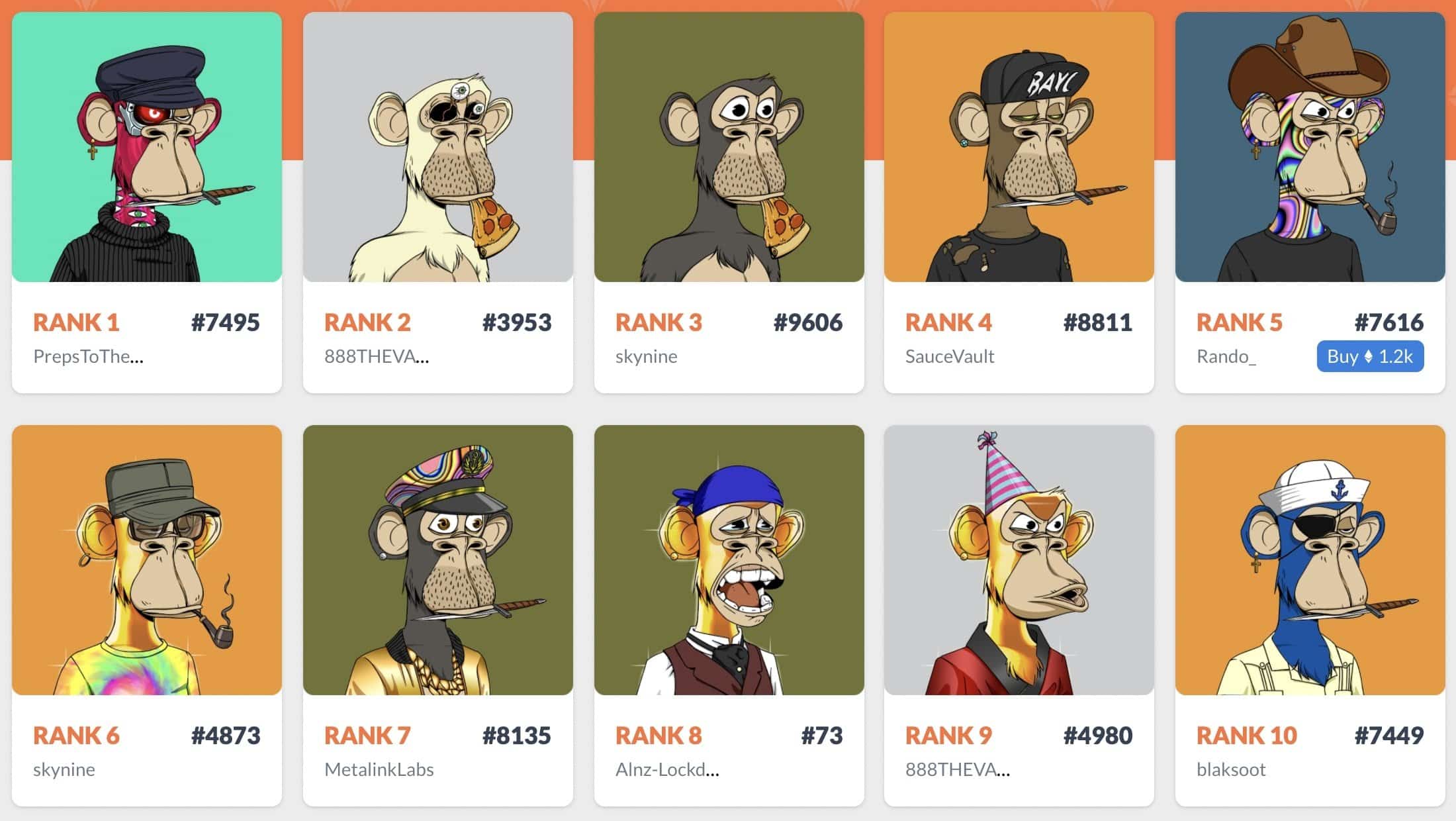

Projects that have 200, 300, or 400 NFTs are not ideal as they struggle to build a community. Projects with a collection of 8,000–10,000 NFTs is enough to maintain scarcity and community engagement.

Look at the Pudgy Penguins collection below. It has a total of 8,888 NFTs and 4,960 owners which means the average NFTs per wallet is 1.79 which indicates a strong community.

8. Look at the NFT Trading Volume Graph

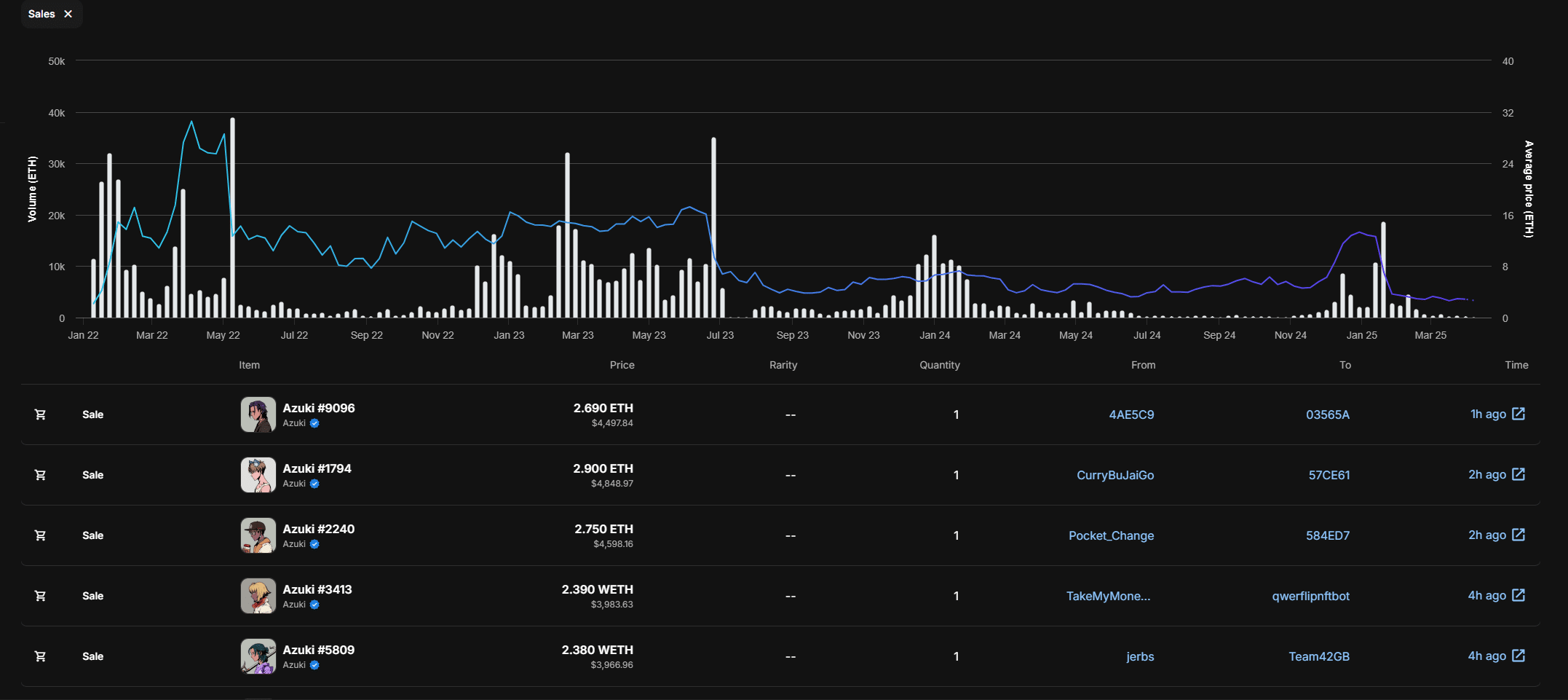

The volume of NFTs traded in a collection is a good indicator of the demand for the project. Look at the increase in trading volume (average price and average sale) during the initial stages and compare it with the last few weeks. If you see a flat graph, then it’s not an ideal project. Look for projects with a strong upward trend over time, not just at the launch of the collection.

Here’s the trading volume graph of Azuki’s collection so far. This is a sign of a good project because the collection is still in demand.

9. Check the Floor Price

The floor price is the lowest listed price for an NFT collection. To evaluate a good NFT project, see if the floor price is increasing over time along with a rise in sales; it indicates strong demand.

10. A Strong, Engaged Community

NFTs are more than just owning a token within a blockchain ecosystem; they’re about connecting with people around the world and creating a culture – a following of people equally passionate about the project as the team that created it.

A strong, engaged community is the soul of any NFT project; it drives success and growth.

To evaluate if an NFT project has a strong community, start with X (formerly Twitter). It’s the place where NFT projects thrive. Use hashtags like #NFT, #nftart, or #NFTCommunity to get into the NFT Twitter rabbit hole and explore upcoming projects.

NFT projects with an engaged following of 20,000 to 100,000 people are worth your attention.

Other platforms where you can evaluate if a project has a tight knit community include Reddit and Discord. Almost every NFT project has a Discord server where people interact and exchange thoughts. You can check Discord servers to gauge the sentiment of the holders and address any “FUD” (fear, uncertainty, and doubt) you may have.

11. Beware of Rug-Pulls

Before investing in any NFT project, beware of “rug-pulls.” We have seen many NFT projects being abandoned and the team escaped with investors’ money. We’ve also witnessed projects engaged in “wash trading” to make the NFT valuable. In wash trading, a person can create an NFT, raise its price, and buy the NFT from another account they own to increase trading volume and make the NFT look valuable to buyers. So, make sure you don’t fall into such traps and carefully verify every detail before making a significant investment.

Parting Thoughts

We know that NFT projects are increasing with time and the rising interest of the community triggers our sentiments to invest in them. So, when you evaluate an NFT Project, stick to two rules: do your research and only spend money that you can afford to lose. Because the space is highly volatile and comes with zero certainties. Even carefully evaluated projects are risky investments and we would advise being extremely cautious.

Keep doing your research, and we’ll catch up in the next mint (our another useful article).

See you in the Spaace, trading your carefully evaluated NFTs.